Tribal

TRIBAL FINANCIAL SOLUTIONS

“Worldly wisdom teaches that it is better for reputations to fail conventionally than succeed unconventionally.” - John Maynard Keynes, Noted British Economist

“Think Different” – Apple, Inc. 1997 advertising slogan via advertising agency TBWA\Chait\Day

Tribal Investment Committees or “Fiduciaries” face a unique set of challenges. A CFA Institute publication authored by Bailey, CFA, Phillips, CFA, & Richards, CFA titled a “Primer for Investment Trustees” captures perfectly one of the primary challenges.

“Let’s face it. Few business assignments are more intimidating than being placed in a position of responsibility outside your area of expertise. Surrounded by subject matter experts awaiting your direction, you find yourself actually expected to make decisions. Even though you are told in the beginning that there are no dumb questions, you don’t want to provide the exception to the rule. A multitude of technical reports full of unfamiliar and complex concepts are quickly thrown at you. Your real day job keeps you busy and offers few opportunities for learning about your new position. So, you sit silent at meetings, lacking confidence, frustrated and concerned about your ability to contribute productively. Well, welcome to the world of the newly appointed investment trustee.”

One likely outcome of the CFA publication is that investment decisions are made by “doing what everyone else is doing.” This can, unfortunately, create more risk in a portfolio as other institutional investors think their “following the herd” towards safety even though the “herd” is heading off the cliff.

At FSA Investment Group (FSA), we believe that tribal investment education is critical.

We focus on creating investment strategies that are designed specifically to meet your tribe’s current needs while ensuring the strategy provides financial strength for future generations.

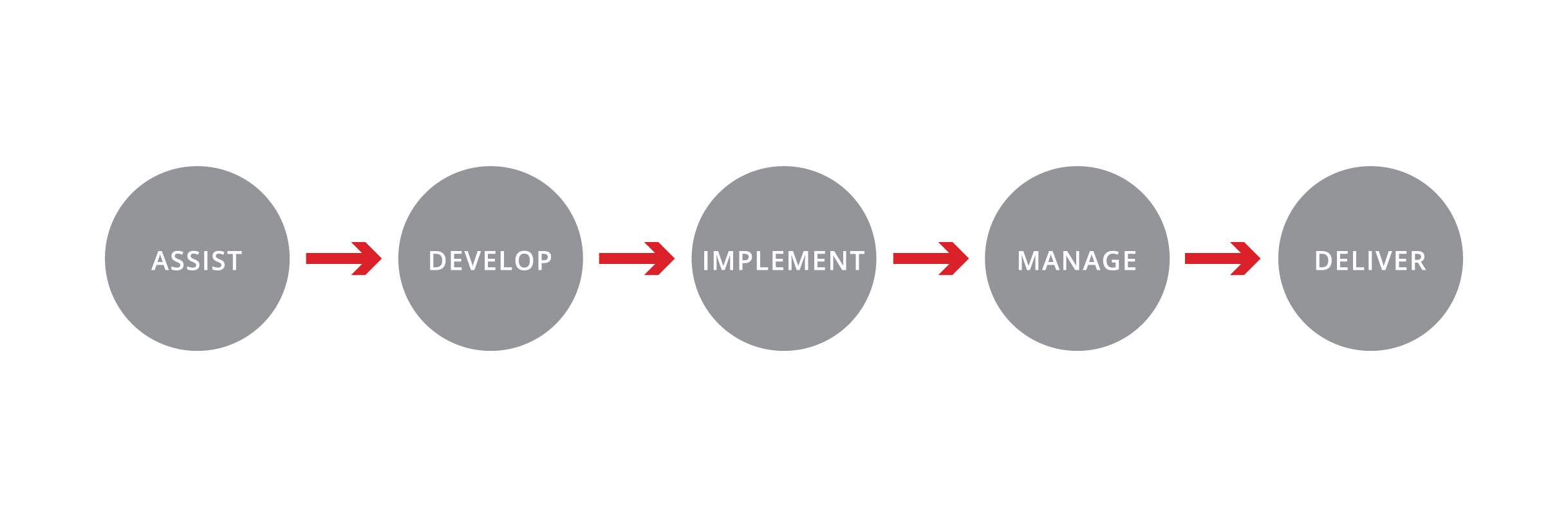

We design and manage programs such as minor’s trust, elder benefit trust, education trust, capital reserve accounts, and cash management. Our process in working with tribal clients to establish an investment account includes the following five steps:

FIVE STEP PROCESS

1. We assist tribal leaders in determining investment goals and portfolio objectives.

2. We develop the investment policy statement which identifies the tribe’s risk tolerance, return objectives, target allocations and responsibilities of the tribe’s investment committee. This step ensures that tribal leaders are fulfilling their fiduciary responsibilities, while mitigating their personal liability.

3. We implement the portfolio with select third party managers and direct investments (if appropriate) through a diversified, valuation driven allocation approach.

4. We manage the portfolio through a comprehensive performance measurement and monitoring process ensuring that your portfolio is meeting its investment goals and objectives.

5. We deliver comprehensive quarterly reports and market updates, educating tribal leaders and investment committees on market directions and how their specific investment strategies are positioned to handle any market environment.

We also assist tribes in developing their tribal Investment Code thereby providing tribal law for the governance of tribal investments. This process may involve the creation and amendment of a tribe’s Revenue Allocation Plan (RAP) to ensure compliance with the RAP and tribal Investment Policy. Once a tribal Investment Code is enacted, investment policy statements may be created for each investment account. We also work with tribes in the establishment, education, and ongoing management of tribal investment committees.

TRUST SOLUTIONS

Specifically related to tribal trusts (minors, elder, education, etc.), we assist tribes with the development of programs which encompass trust design, funding, distribution requirements, and ensuring benefits are managed for appropriate disbursement at future dates.

- We incorporate actuarial data to ensure timely distributions to members.

- We perform actuarial reviews to identify the number of members that will be eligible for distributions on an annual basis.

- We use a defined benefit approach to ensure that funds are always protected and available.

- We work with tribes to incorporate distribution eligibility requirements such as financial literacy classes that will provide tribes the basic knowledge for money management.

- We can provide TPA vendor search services needed for management of trusts or with existing strategic partnerships.

CASH MANAGEMENT SOLUTIONS

We understand the cash flows between tribal enterprises and tribal government and can help develop a strategy that allows you to maximize returns and liquidity on cash and short-term funds all while reducing risks.